-

Notifications

You must be signed in to change notification settings - Fork 93

Description

We can move the functionality of the dripper into the OUSD vault itself, then with only one more storage slot, have protocol owned funds. These would allow OUSD to take a portion of funds into risker strategies, increase long term yield, and have a buffer for reallocation transaction slippage.

Current Setup

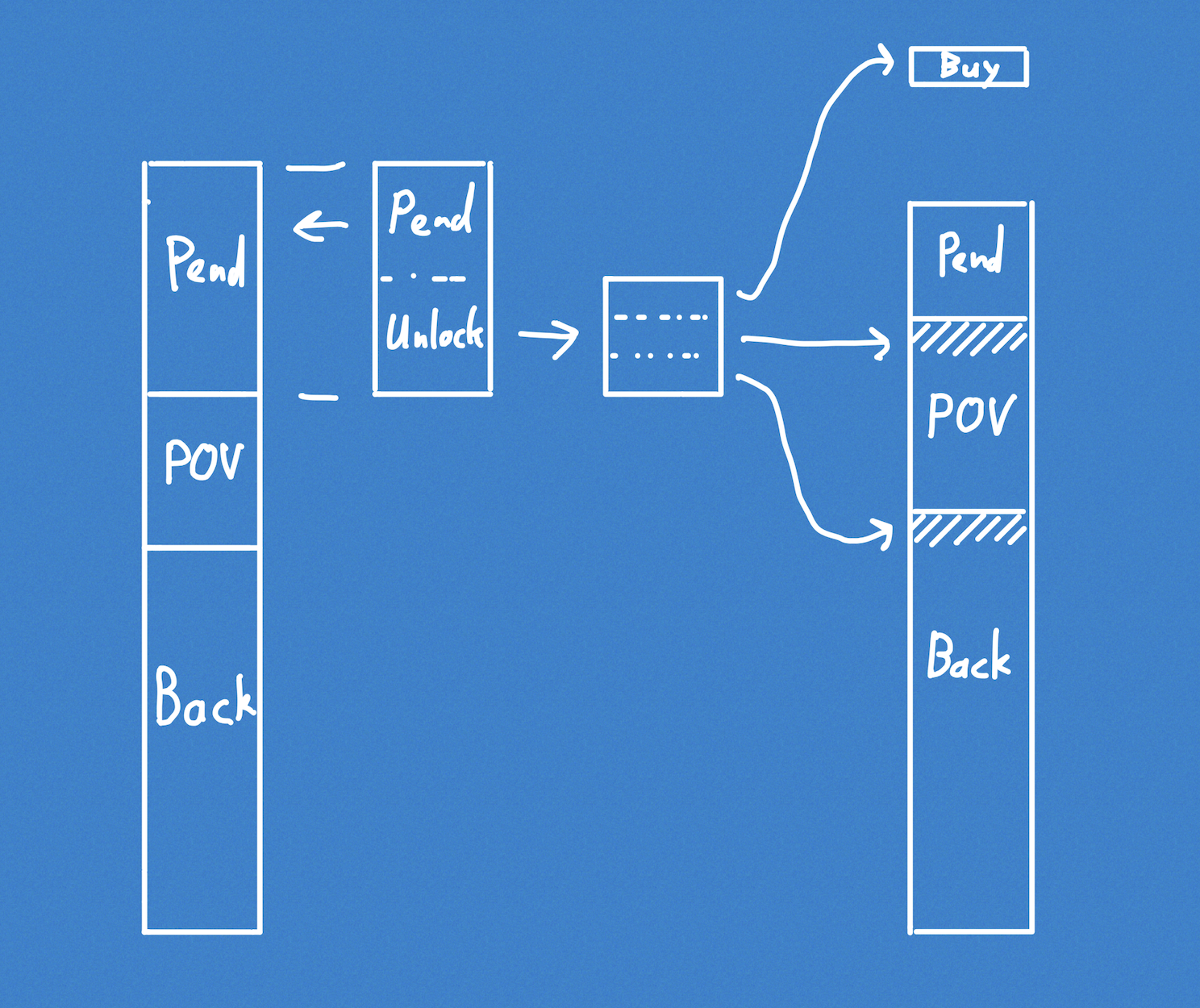

The dripper funds from reward token sales are allocated in two pieces [ pending | unlocked ]. Over time, funds drip over from pending to unlocked. After a collect, this drip rate is reset to a rate that would move all funds over a one week time period.

The vault funds are also in two portions [ backing | unrebased ]. On a rebase, all 10% of un-rebased funds are given to the buyback contract, and the 90% is rebased as balance increases to all holders.

Future setup

The vault would have [ backing funds | protocol owned value | pending]. All funds would be generating yield. All could possibly be allocated into strategies. On a rebase, we would use the dripper style calculations to take a portion of the pending funds (depending on the drip rate) and split it. Perhaps 10% to the buyback, 10% to protocol owned value, and 80% to OUSD holders. Rebases can only have positive effects, as they do right now.

We would have a strategist action that could reduce the protocol owned value accounting value. This could be used as a part of funding reallocations, or compensate for slippage / losses on riskier strategies.

Effects

- Short term APY would be lower if we enabled collecting protocol owned value

- Long term APY would be higher as there's a pool of funds earning on behalf of everyone

- All yield would be smoothed including reward tokens sales, redeem fees yield events from flashloans, gifts to the contract

- Periods of extra high yield, such as liquidity campaigns could build long term APY.

- Could blunt blunt attacks that target rebasing or strategy valuation. By spreading out the apparent gain of funds over a long time period, this gives us time to react, and operates on a scale outside flashloans, and short term gains would be under the rebase fee.

Metadata

Metadata

Assignees

Labels

Type

Projects

Status